Working on a business vision and striving for success and distinction in the business arena is an exciting experience. However, for most startups, finding the right investors to fund their ventures can be an enormous challenge.

Building an investor network is a critical step toward securing the necessary financial support for growth and success. In this article, we will discuss the art of creating an investor network and outline some proven strategies for connecting with the right people who will share your vision and passion for innovation.

Determine Funding Needs and Investor Selection Criteria

Defining funding needs and selecting criteria for potential investors is a pivotal point for any startup. Firstly, new businesses must thoroughly assess their financial requirements, fully understanding the capital needed for launch, expansion, and ongoing operations.

On the other hand, potential investors should possess specific characteristics that align with the startup's goals. Beyond financial capacity, investors should ideally have experience and a deep understanding of the startup's sector.

Furthermore, investor selection should not be based solely on financial criteria. Contribution of added value, such as mentorship, networking opportunities, and growth potential, should also be considered to significantly boost the startup's chances of success. By effectively aligning funding needs with investor criteria, every startup can attract partners who share its vision and contribute not only capital but also invaluable resources and expertise.

Leverage Existing Networks

When seeking investors for a startup, identifying and leveraging existing networks can be a game-changer. Tap into your personal and professional connections to pinpoint potential investors who may share the same passion for your venture. Networking events, conferences, and industry gatherings provide fertile ground for connecting with individuals and organizations that resonate with your ideas.

In addition, seeking advice from mentors, executives, or successful entrepreneurs who have already raised capital can offer priceless insights and guidance on the funding journey.

Research and Identify Potential Investors

Finding and identifying potential investors is another critical step in the capital-raising process for any startup. It begins with thorough research into investors who have a history of supporting ventures in your sector.

Platforms like LinkedIn offer a wealth of information for evaluating potential investors, including their investment preferences and past investments.

Beyond individual investors, startups should also explore the possibility of partnering with venture capital firms and fundraising platforms. Furthermore, investigating government programs and funds aimed at supporting startups can yield valuable financial assistance and resources.

Create a Compelling Presentation

Crafting a compelling presentation of your vision is a skill that can yield impressive results for a startup. An attractive presentation must communicate the venture in a balanced way and not merely embellish the proposal. It must be concise and captivating, capturing the essence of the business idea, market dynamics, growth strategy, and potential challenges.

It is crucial to highlight what differentiates the proposal from competitors, emphasizing its unique value proposition for the audience and the competitive advantage it creates. The presentation must also clearly and specifically reflect financial forecasts, demonstrating a clear path to profitability and sustainable growth.

Create and Build Relationships

Creating and building relationships with potential investors constitutes a fundamental aspect of successful capital raising for startups. Effective communication at every opportunity is key. To forge effective relationships, you must convey your passion, expertise, and the progress the startup has made in the sector during every interaction.

Furthermore, being receptive to feedback and advice, even if an investor is not ready to commit at that specific moment, demonstrates a positive attitude and a willingness to learn and improve.

Utilize Every Resource & Available Support

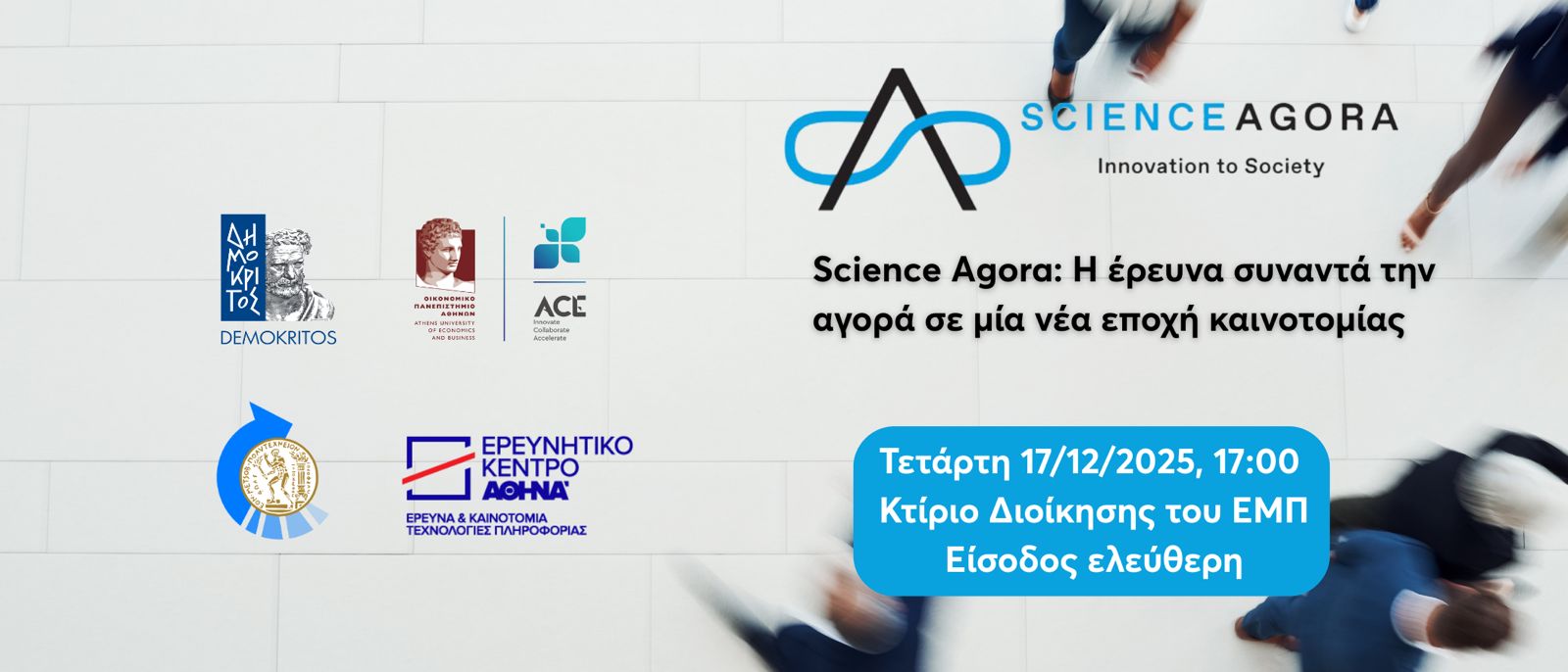

Leveraging all available resources and support can be a game-changer for startups seeking funding. There are organizations actively supporting businesses, as well as business accelerators that often function as invaluable connectors, bridging the gap between investors and startups.

By utilizing these networks, startups gain access to numerous opportunities, such as pitch events, workshops, and conferences where they can present their venture to interested investors. Participation in such activities not only boosts visibility but also fosters relationships with potential funders. Moreover, the contact networks created through these interactions form a web of potential partnerships, collaborations, and relationships that can open doors to new sources of funding and expertise.

In Conclusion

In conclusion, building an investor network for any startup is a multifaceted process that demands persistence, dedication, and a strategic approach. Building relationships with potential investors is the foundation of success. Conducting thorough research to identify the right investors who align with the startup's goals is also vitally important.

Equally crucial is developing the skill of crafting persuasive proposals and presentations that capture the interest of potential investors, highlighting the unique value proposition for the audience and the startup's potential for growth. Securing the necessary funding for a startup's development and success is often a game of endurance and adaptability.